Managing Your Money: How to Be More Financially Responsible

According to some research, 53% of Americans don’t have any type of emergency savings.

If you’re interested in becoming financially responsible and setting yourself up for success.

Keep reading to find out all you need to know about setting budget goals, saving money, and overall money management.

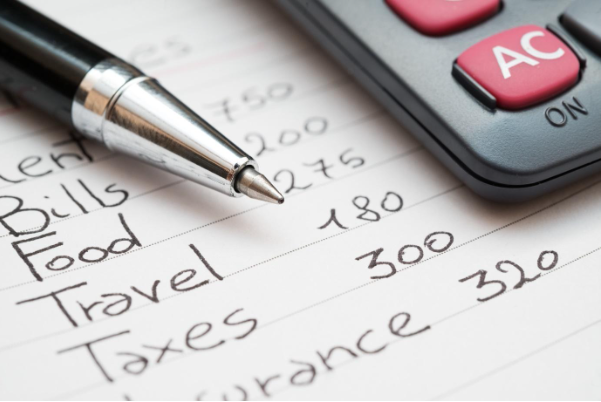

Create a Budget

The first step is creating a budget. This is a great way to hold yourself accountable and know where your money is going.

There are different budgeting methods, so you’ll need to find one that’s easy for you to stick to. For example, you could try spending 80% of your income and always saving 20% for your emergency fund.

Manage Debt

You should learn about the process of resolving debt to become debt-free. Most Americans are in debt, whether it’s through loans or credit card debt. However, you can’t ignore it.

The longer you ignore it, the more expensive and challenging it will be to get out of debt.

You need to manage your repayments, or it could end up affecting your credit score. Your credit score will also impact how much interest you have to pay on any future loans, so this could have dramatic costs later on down the road as well.

If you have too much credit, then you may want to try refinancing all of your debt. This way, you can get a lower interest rate, which makes it much more manageable to pay off.

Create an Emergency Fund

When you have a budget and can start saving, you can create an emergency fund. Financial responsibility means that you’re prepared for anything that is unexpected.

Many experts agree that you should save enough money that could last you for six months without any income. You’ll need enough money to pay for food, utilities, and rent or your mortgage.

If missing one paycheck could ruin your financial goals, then you’ll need to create a financial safety net.

Maximize Your Income

One way that you can help yourself save money is by maximizing your income and savings. You can maximize your income by investing in stocks, funds, and retirement accounts.

You may also want to consider hiring a financial advisor who can help inform you of the best places to invest your money. Even if you start investing a little bit of money each month, this can compound and give you great returns.

You can also open a high-yield savings account. This savings account is a great way to maximize your savings without having to do anything. As inflation keeps getting higher, the rates of these accounts keep going up as well!

Discover More About How to Be Financially Responsible

These are only a few things to know about how to be financially responsible, but there are many other tips that can help you manage your money.

We know that becoming financially responsible can be challenging, but we’re here to help you out.

If you’re interested in learning more about money tips and tricks, check out the rest of our articles under Finance!